Happy Sweet 16, Bitcoin!

Wealth Matters 3.0 Celebrates Your Journey of Resilience and Coming of Age Momentum!

Happy Birthday Bitcoin and thank you Satoshi Nakamoto for your labor of love 16 years ago today! As Bitcoin celebrates its 16th birthday, it’s clear that the journey from whitepaper to global phenomenon has been marked by both resilience and innovation. Here are 16 key moments in Bitcoin’s first 16 years, followed by a look at its promising future as it truly comes of age, literally and figuratively, fueled by Layer 2 advancements and expanding ecosystems both inside and outside the Bitcoin network.

Celebrating Bitcoin's First 16 Years: Key Milestones

Whether you are brand new to the history of this incredible invention or an O.G. this is a short list of some highlights over the years that have proven our precious Bitcoin to be both resilient and steadfast, but explosively promising in its global potential.

1. Whitepaper Publication (October 31, 2008): Satoshi Nakamoto’s whitepaper, Bitcoin: A Peer-to-Peer Electronic Cash System, was published, proposing the first decentralized currency.

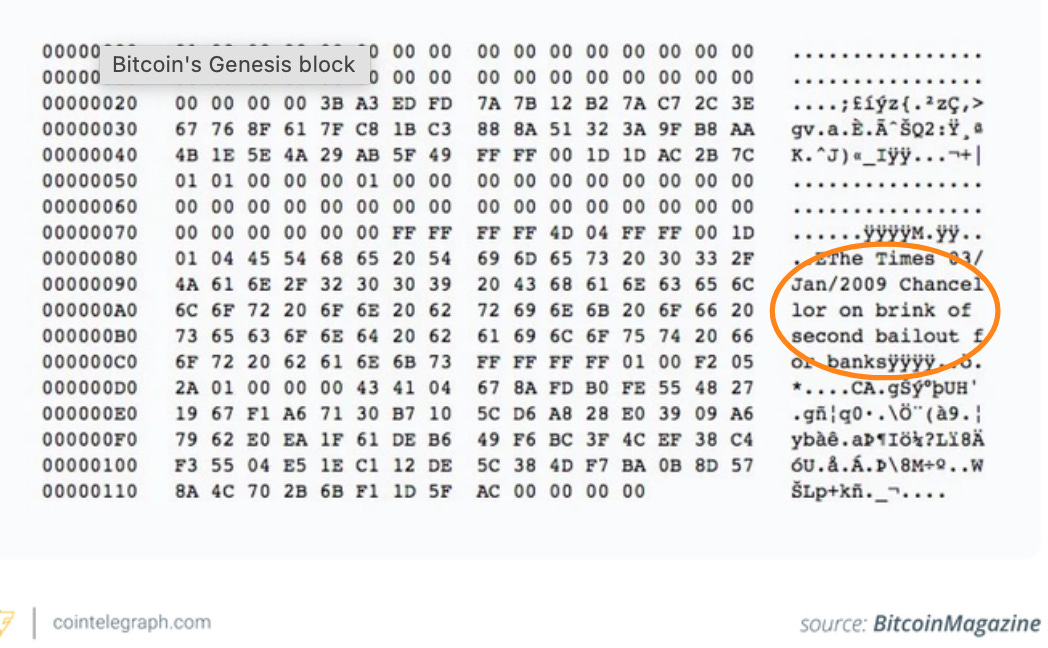

2. Genesis Block (January 3, 2009): Satoshi mined the first Bitcoin block, embedding a message reflecting the 2008 financial crisis “Chancelor on brink of second bailout for banks”

3. First Bitcoin Transaction (January 12, 2009): The first transaction took place between Satoshi and cryptographer Hal Finney, signaling the start of Bitcoin's decentralized currency model.

4. Bitcoin Pizza Day (2010): May 22, 2010, marked the first real-world Bitcoin transaction, where Laszlo Hanyecz bought two pizzas for 10,000 BTC.

5. Mt. Gox Launch, initial hack/theft, and crash (2010, 2011, 2014): Mt. Gox became the largest Bitcoin exchange, helping grow Bitcoin’s user base and trading ecosystem, but it also created the first large-scale series of theft and lost Bitcoin and many predicted this to be one of the initial “deaths” of Bitcoin. Read the full story of Mt. Gox here.

6. Parity with USD and Satoshi Leaves Bitcoin Forever (2011): In February 2011, Bitcoin reached parity with the US dollar (1$=1BTC) for the first time, a symbolic milestone that attracted broader attention and in April 2011 Satoshi posted their final message “I’m moving on to other things.” and left us their invention to raise as a global village of passionate volunteers.

7. Silk Road Shutdown (October 2013): The FBI shut down Silk Road, an online marketplace using Bitcoin for transactions and arrested its founder Ross Ulbricht, bringing increased regulatory scrutiny to the asset and network.

8. Mt. Gox Collapse (2014): In 2014, Mt. Gox filed for bankruptcy after losing approximately 850,000 bitcoins, underscoring the need for secure exchanges.

9. Block Size Debate (2015): Bitcoin’s scaling debate began, leading to discussions on how to handle increasing transaction volumes as alternative (competitive) cryptocurrency chains and scaling solutions from Ethereum to Cardano begin to recruit developers to do the things that can’t occur yet on top of the Bitcoin blockchain.

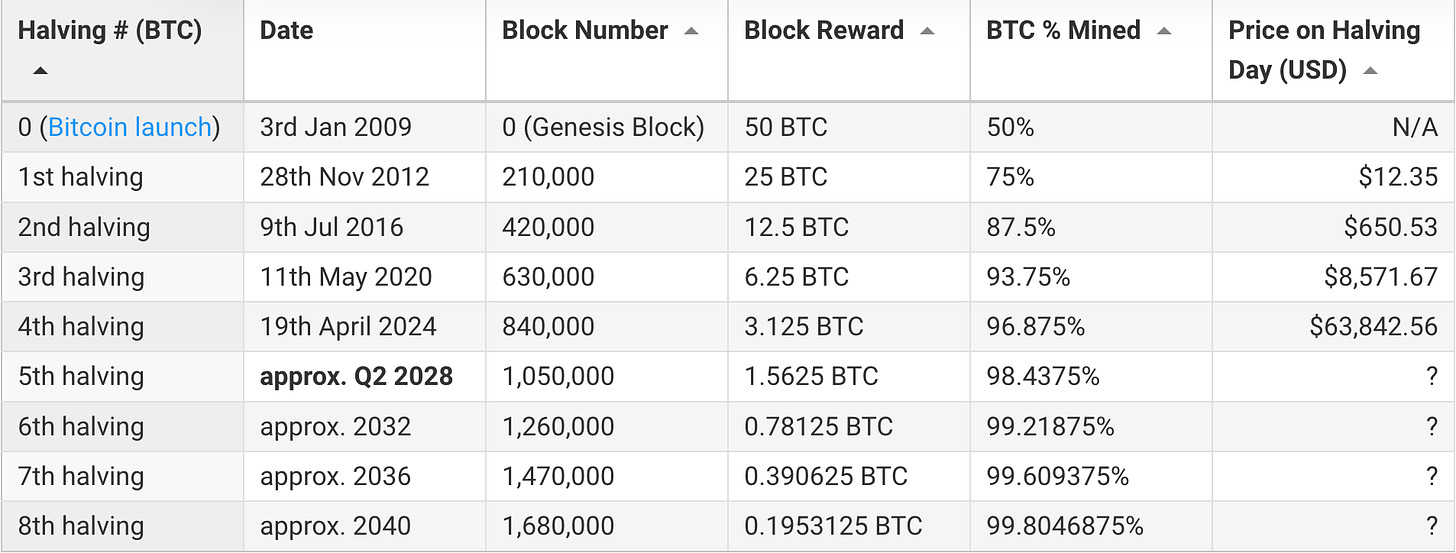

10. Second Halving (2016): Bitcoin’s second halving on July 9, 2016, reduced mining rewards (the payment received by those who maintain the network’s uptime) from 25 BTC to 12.5 BTC per block and reinforced its scarcity model. Bitcoin halvings happen every 210,000 blocks until approximately the year 2140. That is the projected year that all 21 million bitcoins will have been mined that will ever exist. However, as you can see from the table below, over 98% will be mined and in circulation by 2028.

11. SegWit Activation (2017): Segregated Witness (SegWit) was activated, allowing for more transactions per block and setting the stage for the Lightning Network.

12. Bitcoin Cash Fork (2017): Bitcoin Cash was created (and the first major hard fork of the code base) in August 2017, reflecting differing visions within the community on scaling and creating what many believed would be another “death” of Bitcoin. Yet as time has shown it still survived and thrived again.

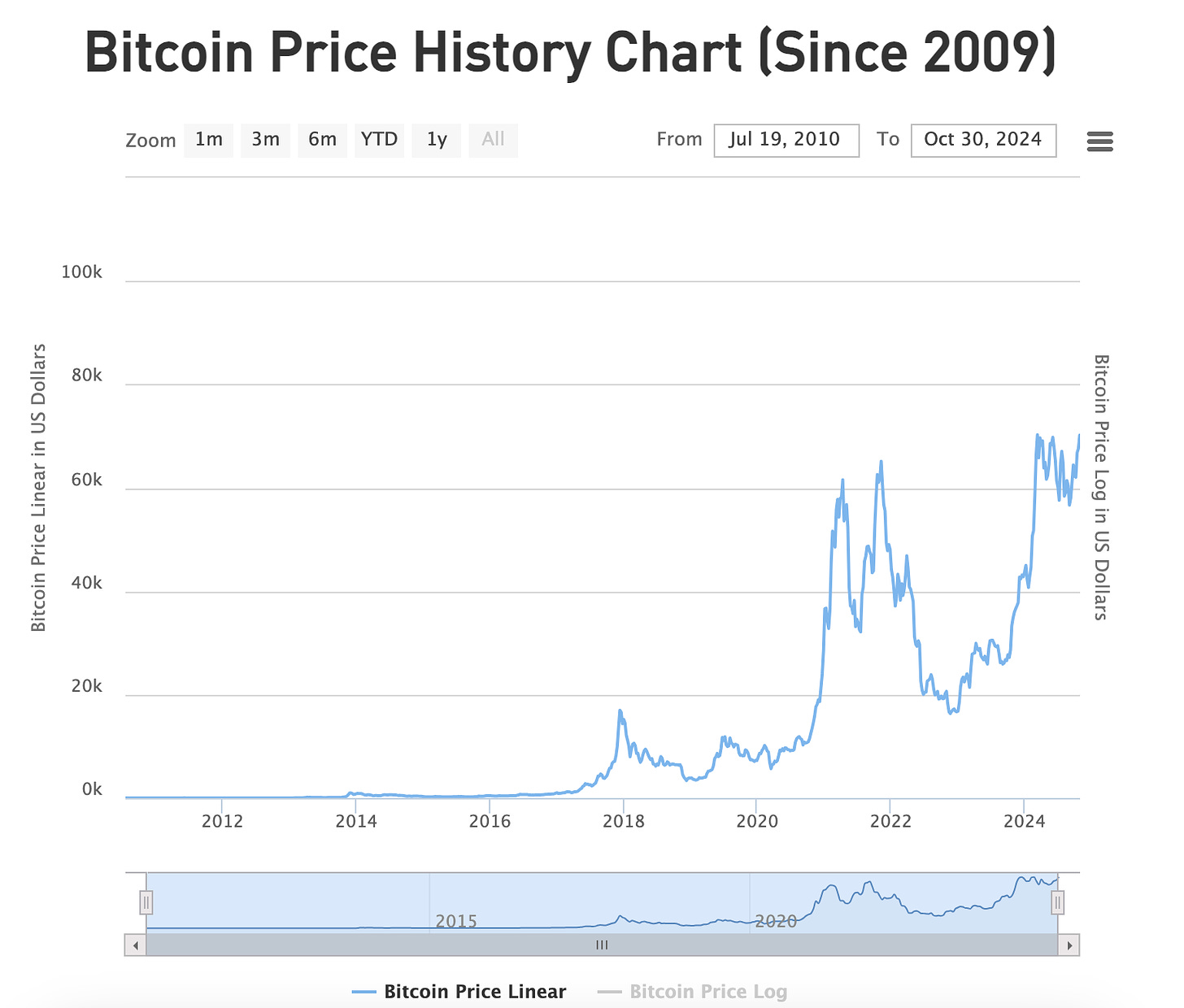

13. All-Time-High Price Surge (December 2017): Bitcoin’s price surged to nearly $20,000 before coming back down, marking its first major bull run and establishing its role as a potential store of value.

14. Lightning Network Launch (2018): The Lightning Network launched in 2018 as the first major layer 2 designed to facilitate faster, cheaper, and more efficient payments atop the Bitcoin network.

15. El Salvador Adopts Bitcoin (June 2021): El Salvador became the first country to adopt Bitcoin as legal tender, demonstrating its potential as a national currency.

16. Taproot Upgrade (2021): The Taproot upgrade enhanced Bitcoin’s privacy and scripting capabilities, allowing for more complex transactions and smart contracts and allowing the recent and controversial innovations like Ordinals (non-fungible inscriptions), Runes (fungibles), and more programmability on top of the Bitcoin settlement Layer.

Phew, so that is a short list of highlights from Bitcoin’s first 16 years not including the recent global ETF approvals, etc, and the far too many rebuked attempts to kill it to count. The one thing that is for sure as Bitcoin enters young adulthood is that the probability that it goes to zero is near zero, and its compounding growth and innovation in the coming 4 to 5 years will be mind-blowing.

Looking Ahead: Bitcoin’s Growing Ecosystem and Cross-Chain Integration

Bitcoin’s teenage maturity has now sparked explosive innovations within the network and the broader crypto ecosystem over the last 12 months. As we enter Bitcoin’s “coming of age” era, Layer 2 innovations and recent cross-chain developments this week such as those pioneered by Cardano-centric projects and the BitcoinOS layer, are positioning Bitcoin as more than a store of value and ultimately as the global settlement layer for all crypto and tokenized real-world assets.

Here’s a look at how this evolving synergy could shape Bitcoin’s future.

Layer 2 Developments on Bitcoin

Since its 15th Birthday in October of 2023, Bitcoin’s Layer 2 solutions have expanded dramatically, allowing for faster, cheaper transactions while preserving the security of the main chain. Notable projects include:

- Stacks Nakamoto Upgrade (October 29, 2024): Stacks, a prominent Layer 2 project, launched its Nakamoto upgrade this week, which increased transaction finality and set the stage for sBTC, a Bitcoin-pegged asset designed for DeFi applications【9†source】.

- Explosive Growth in Layer 2 Total Value Locked (TVL): By August 2024, Bitcoin Layer 2 TVL reached an estimated $1.09 billion, demonstrating a 5.8x increase since January 2024 and an 18.7x increase since January 2023.

- Leading Layer 2 Projects: The top projects by TVL in August 2024 included Bitlayer, CoreDAO, Rootstock, Stacks, and Merlin, each contributing significantly to Bitcoin’s DeFi ecosystem.

Cross-Chain Potential: Cardano and Bitcoin

The integration of BitcoinOS with Cardano has unlocked unprecedented interoperability:

- Uniting the Crypto Nations on top of Bitcoin-Possibilities: This week’s recent example of major alt-coin networks coming back to Bitcoin are a huge signal of what might come. While IOHK’s Cardano, Midnight, and Atala PRISM protocols weren’t originally designed for Bitcoin, Cardano was inspired by the UTXO model and now the BitcoinOS layer could facilitate their adaptation and migration back to become Bitcoin L2s and bring a tremendous amount of DeFi and privacy utility on top of the Bitcoin settlement layer. For instance:

- Midnight’s Zero-Knowledge Protocols: Using zero-knowledge proofs on BitcoinOS could offer a level of privacy on Bitcoin similar to what Cardano's Midnight protocol aims to achieve.

- Decentralized Identity with Atala PRISM: Bitcoin’s identity verification could benefit from Atala PRISM, with a sidechain or bridge adapting Cardano’s decentralized identity features to Bitcoin's UTXO model【10†source】【9†source】.

- Grail Bridge Integration: This tool enables a chain like Cardano to tap into Bitcoin's liquidity, allowing for trustless transfers and facilitating DeFi applications across both networks.

---

Conclusion: Bitcoin’s Bright Future

As Bitcoin enters its 17th year, it does so with the momentum of not only its dedicated community but also a growing network of interoperable ecosystems. With advancements in Layer 2 scalability, integration with protocols like BitcoinOS, and cross-chain initiatives, Bitcoin is poised to enter a new era where it can participate in DeFi, support identity solutions, and more. Here’s to a future where Bitcoin continues to challenge the limits of what digital assets can achieve, powered by both internal innovations and cross-chain collaborations.

TUNE IN TODAY AT 4pm EST/1pm PST on Twitter for our Bitcoin Future Show live. Get the link here

Happy Sweet 16, Bitcoin! I think it will be a year for the ages!