Opportunity of a Lifetime or Missed Opportunity?

Why the 2026 Sunset on Opportunity Zones May Be the Market’s Most Underrated Risk—Or Biggest Catalyst

In 2017, the Tax Cuts and Jobs Act (TCJA) introduced what some have called the most powerful economic development tool of the 21st century: Opportunity Zones (OZs). Designed to incentivize long-term investments into underserved communities through tax deferrals, step-ups in basis, and total capital gains exclusions, the OZ program has since attracted over $120 billion in investments.

But as the calendar inches closer to December 31, 2026, investors face a pivotal crossroads. This is why getting the TCJA extensions through Congress this Summer is Scott Bessent and President Trump’s top priority.

The OZ provisions—especially the ability to defer capital gains and earn stepped-up basis reductions—are scheduled to expire in full unless Congress acts. Whether we get a renewal or a sudden cutoff will shape not just portfolios, but entire asset classes, from commercial real estate (CRE) to small businesses and regional banks.

Let’s break down what’s at stake.

The Original Opportunity Zone Tax Benefits

The 2017 law included a compelling trio of benefits for investors who reinvested capital gains into Qualified Opportunity Funds (QOFs):

Capital Gains Deferral until as late as 12/31/2026.

Step-Up in Basis: A 10% reduction in tax liability after 5 years, and an additional 5% after 7 years.

Capital Gains Exclusion: Hold the investment for 10+ years and pay zero capital gains tax on appreciation.

However, step-up benefits expired after 2021. The only remaining advantage for new investments is the 10-year exclusion on new gains—but only if invested by December 31, 2026.

What If Congress Doesn’t Act?

If the law sunsets without renewal, the consequences will ripple across sectors:

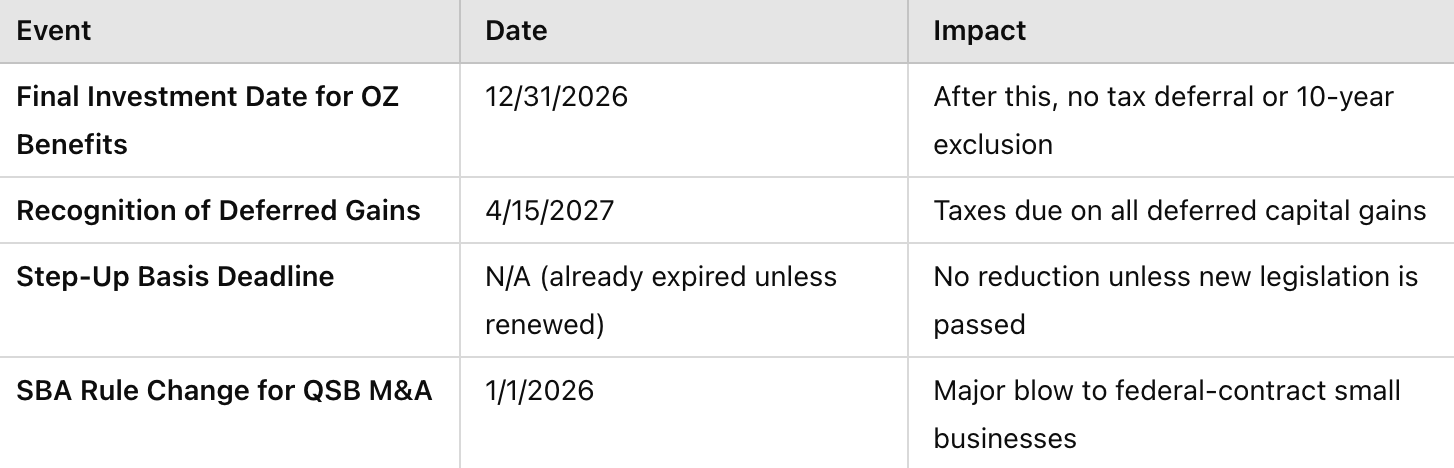

🔻 Capital Gains Recognition in 2027

Investors must pay taxes on all deferred gains by April 2027, regardless of whether the OZ asset is sold. Without proper planning, this could lead to significant liquidity strain.

➡️ (Warren Averett)

❌ Loss of Step-Up Incentives

New investors will permanently lose the ability to reduce tax on deferred gains. Only the 10-year appreciation exclusion remains for those investing before the deadline.

➡️ (Novogradac)

🚫 No Tax Benefit for Post-2026 Investments

After 12/31/26, any new OZ investment will not qualify for any tax incentives—not even the 10-year exemption.

➡️ (IRS FAQ)

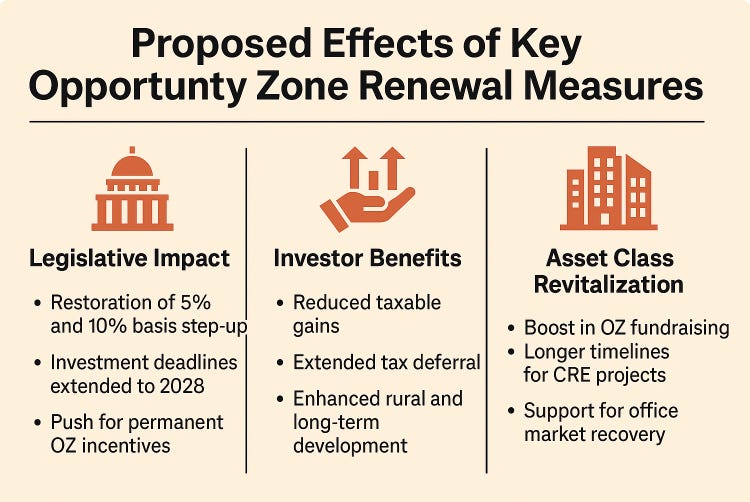

What If It Is Renewed? Pending Proposals Include:

Here’s what Republican lawmakers, alongside private sector advocates, are proposing:

✅ Restore Step-Up in Basis Benefits

Reinstating the 10% (5-year) and 15% (7-year) reductions on original capital gains, retroactive to 2022 investments, to reignite enthusiasm.

➡️ (OpportunityZones.com)

✅ Extend OZ Investment Deadline to 2028

This would give investors more runway to qualify for step-up benefits, and appreciation exclusions and gain eligibility for tax-free growth into the 2030s.

➡️ (Tax Foundation)

✅ Make OZ Benefits Permanent

Some legislators want to make the OZ framework a permanent fixture of the tax code, reducing uncertainty and encouraging long-term development plans.

➡️ (Novogradac)

The Political Landscape: Where We Stand

Trump 2.0 Outlook: Donald Trump has called Opportunity Zones "one of the best economic programs ever created." If re-elected, expect a renewed focus on OZ reform in a 2025 tax overhaul.

GOP Budget Push: Republicans are crafting a 2025 reconciliation bill to extend and expand OZs without needing full Democratic support.

Democratic Resistance: Some critics argue the program lacks transparency and may have disproportionately benefited wealthy investors. Any bipartisan version may require stronger accountability and reporting rules.

➡️ (PBS)

The Hidden Risk: What Happens If OZs Expire?

The expiration of OZ incentives won’t just affect investors—it could destabilize entire sectors.

🏢 1. Commercial Real Estate (CRE): Most At-Risk

CRE—particularly office space—faces overlapping threats:

Tax-Driven Liquidation: Capital gains must be recognized in 2027, pushing investors to liquidate OZ-linked properties in 2025–2026 to cover tax obligations.

Remote Work Fallout: U.S. office vacancy is projected to hit 24% by 2026, slashing valuations by $250 billion.

➡️ (Bloomberg)Refinancing Crunch: $929 billion in CRE loans mature by 2028. Without OZ investor capital, distressed assets could flood the market.

➡️ (Morgan Stanley via Yahoo)

📉 Estimated Impact: 20–40% decline in office property valuations, especially in secondary markets and older buildings.

🧑💼 2. Qualified Small Businesses (QSBs): Quiet But Vulnerable

QSBs are also in the crosshairs—especially those dependent on federal contracts.

SBA Rule Changes (2026): A major shift in SBA acquisition regulations could make many QSBs unattractive or ineligible for federal contracts post-sale, devaluing backlog-heavy businesses by up to 75%.

➡️ (SBLiftoff)M&A Acceleration: 2025 could see a mad dash of M&A activity before rules take effect, then a sharp slowdown in 2026.

➡️ (CBH Insights)

📉 Estimated Impact: 15–25% drop in QSB valuations post-2026.

💥 3. Broader Market Effects

Regional Bank Stress: Banks with CRE exposure could face cascading risks from distressed OZ-linked property sales.

Capital Freeze: Uncertainty could discourage long-term development or business expansion in OZ-designated communities.

Investor Sentiment Drop: If tax benefits vanish, the risk/reward for illiquid, long-dated OZ investments diminishes considerably.

Timeline for Investors: Key OZ Deadlines

Checklist: How to Prepare for Either Scenario

✅ Model Tax Scenarios for 2027

Run forecasts now for potential capital gains tax owed, and plan accordingly—consider liquidity needs and tax-loss harvesting.

✅ Accelerate OZ Deployments Before 2026

If you believe in tax reform's upside, make strategic investments now to potentially qualify for future retroactive benefits.

✅ Stress Test CRE and QSB Holdings

Prioritize refinancing timelines, tenant health, and loan-to-value ratios. Evaluate business model resilience for QSBs tied to federal contracts.

✅ Track Legislation Closely

Bills like H.R. 5761 and OZ working group recommendations will shape what comes next.

Time is the Most Undervalued Asset in OZ Planning

Whether you’re a private investor, developer, or advisor, the next 12–18 months may offer once-in-a-decade tax advantages—or mark the end of an era. Don’t wait for legislative clarity to begin proactive planning. Because when the music stops in 2026, those without chairs—or liquidity—may find themselves scrambling.

Yours in health and wealth,

~Chris J Snook