The Guns of April: Are We Repeating the Mistakes of Economic History or Witnessing a Strategic Reset of Global Trade?

The Wealth Matters Weekend Playbook for Investors Seeking Clarity and Context on the Behavior of Markets and Humans

The posts this week are coming fast and heavy because I can’t help but think that more historical and forward-looking context and understanding of human behavior are needed to help you “calm down” so you can speed up” your search for certainty inside the multitude of polarized commentary from the typical pundits and politically biased duopoly. Hopefully, this additional thought piece will help you find the signal you need to work with your advisors on the best way to position your portfolio against your personal investment time horizons and wealth preservation goals.

I felt it was appropriate in today’s second post to you to revisit the lessons from a long-forgotten book…

In The Guns of August, Barbara Tuchman detailed how miscalculations and rigid alliances sparked the First World War—turning what could have been a contained conflict into a generation-defining catastrophe. Over a century later, as April 2025 unfolds, we are witnessing another kind of escalation: one rooted in tariffs, global capital shifts, and geopolitical positioning.

This time, the battlefield is economic, and the stakes are no less dangerous for global investors who must navigate volatility.

History Doesn’t Repeat—But It Rhymes

Trade wars often begin with good intentions and end in unintended consequences. Consider these three cautionary tales:

1. Smoot-Hawley Tariffs (1930)

Aimed at protecting U.S. agriculture, the act led to retaliatory tariffs from over 20 countries. U.S. exports plunged 66%, deepening the Great Depression instead of averting it.

2. The Chicken War (1962)

After the EEC imposed tariffs on U.S. chicken, the U.S. hit back with tariffs on brandy, potato starch, and light trucks—disrupting consumer markets and cementing long-term trade inefficiencies that linger in the auto industry even today.

3. U.S.-China Trade War 1.0 (2018–2020)

Intended to curb IP theft and rebalance trade, the tariffs slowed U.S. GDP by 0.2% and erased 142,000 full-time jobs. Now in its second act under President Trump’s renewed leadership, tariff rates on Chinese goods exceed 54%, and allies like Canada and Mexico are also being targeted.

Trump’s 2025 Trade Doctrine: Allies, Enemies, and Everyone in Between

The second Trump administration is leaning into economic nationalism—escalating tariffs across the board. Retaliation, as well as some capitulation, has come quickly from partners and rivals alike, with new tariffs on U.S. agriculture, tech, and energy exports. These reciprocal moves amplify volatility and near-term uncertainty in global markets, and Wall Street (as typical) is pouring gas on the fire (for profits on the Trump Put) as the shorts pile in for a hedge to ensure their q2 reports don’t evaporate. For everyday investors, small business owners, and their advisors, this causes more fear and misunderstanding than anything as they try to decide what, if anything, they should do as it plays out.

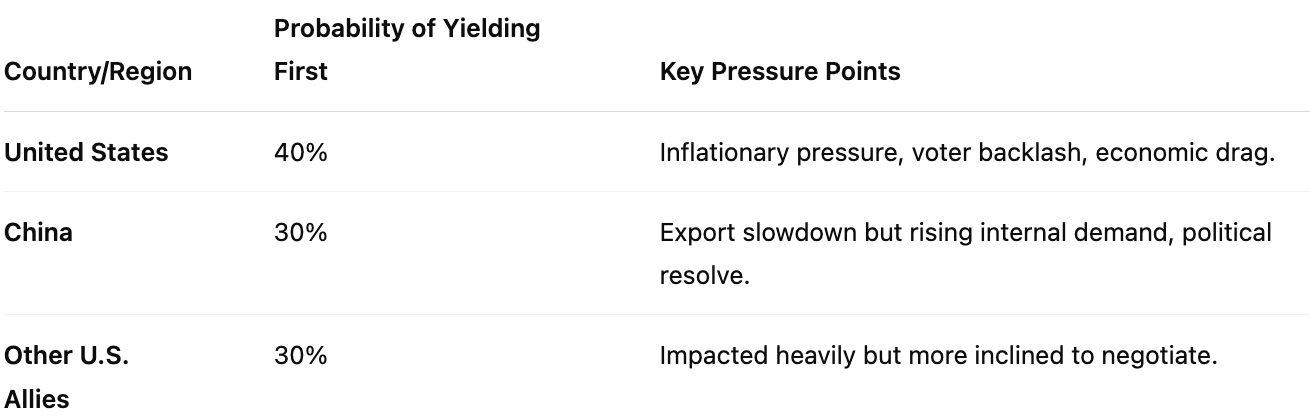

Probability Forecast: Who Yields First?

This chart is what a few different data sources aggregated by my personal AI tool believe the probability of who yields first looks like. However, I read Art of the Deal multiple times years ago, and my personal opinion is that given some of the hidden signals of capital flows in the last three days shown below, these numbers are not the base case. Consider both since I may be wrong, but I believe the U.S., with the alignment of the current Administration, is more like a 25% yield first probability (the last to yield in most cases), with China, EU, and others being closer to 40%, and India could be the ultimate lever in this new world order’s early days.

Who Yields First According to AI

This economic "game of chicken" could reach its inflection point if a bloc—say, China, the EU, and Canada—applies coordinated counter-pressure. Similarly, I believe it could reach a tipping point favoring the Trump 2.0 strategy, with India, Saudi Arabia, and Singapore playing key roles.

Capital Flows Reveal a Hidden Signal in the Noise

From March 31 to April 3, 2025 (the last three days), global capital behavior reveals key undercurrents:

Digital Assets See a Surge

$226 million flowed into digital asset funds, with Bitcoin alone receiving $195 million.

After weeks of outflows, altcoins also saw renewed interest.

The U.S., Switzerland, and Germany led inflows; minor outflows occurred in Hong Kong and Brazil.

India’s Financial Sector Attracts Billions

Foreign portfolio investors injected $2.06 billion into Indian financial stocks in late March—the highest inflow in 15 months.

Despite this, $12.7 billion exited Indian equities in the fiscal year, showing that optimism is sector-specific.

My Simplified Takeaway for what it means:

Money is flowing into Bitcoin again after a cautious pause—indicating renewed risk appetite. Meanwhile, India’s financial sector is drawing major foreign investment, even as broader equity flows remain negative—signaling targeted confidence in India’s long-term role.

India’s Strategic Rise: A Signal for Investors

India stands at a critical junction of growth and geopolitics:

GDP growth is projected at 6–8% per year, fueled by digital expansion and policy reforms.

New laws permit 100% FDI in insurance, and the government is doubling the cap for foreign individual investments in listed companies.

India is central to the “China-plus-one” strategy, attracting Western supply chains looking to diversify.

India’s growing alignment with the U.S. in tech, defense, and trade positions it as a geopolitical hedge against China. Yet, this balancing act is delicate—China remains India’s largest trading partner.

Investor Playbook: Positioning for Uncertainty

Trade wars and capital shifts are not just macro trends—they’re signals to rebalance. Here's how forward-looking investors are adjusting:

1. Hedge with Bitcoin and Digital Assets

As fiat uncertainty rises, capital is once again flowing toward Bitcoin. Institutional inflows signal confidence, not speculation.

2. Diversify into Resilient Regions

Southeast Asia and India offer geopolitical insulation and structural growth drivers. Sectors like infrastructure, financials, and digital services are compelling entry points.

3. Defensive Assets and Domestic Revenue

Gold and commodities remain hedges. Domestically anchored firms, particularly those driven by U.S. demand, provide downside protection. Opportunity Zone Funds and QOZBs (Opportunity Zone Businesses) could become a resurgent asset class that money pours into domestically upon the renewal of the TCJA of 2017.

4. Currency and Yield Management

The dollar remains strong—but volatility is rising. Consider exposure to local currencies where capital flows are increasing (e.g., INR), and remain alert to Treasury yield shifts.

Conclusion: Economic Sarajevo or Strategic Reset?

The “Guns of April” moment in 2025 is economic, not military. But the stakes are just as high. As tariffs fly, trust erodes, and capital reroutes itself, leaders have a choice: escalate for political points or de-escalate for global growth.

Investors, meanwhile, must do what nations often fail to—respond rationally, adapt dynamically, and prepare strategically. Look beyond the headlines. The flows don’t lie. Follow the money and human behavior in times of panic and uncertainty, and realize emotions make the choice, and logic is always how it becomes justified.

Stay sane out there!

~Chris J Snook