Why Small Human-Centric Business Rollups May Be the Wealth Opportunity of the Century

The Great Robot Scaling Dilemma and ATOMIQ Capital's Investment Thesis 2025-2035

In a world racing toward automation, the rarest and most valuable asset over the next 25 years won’t be AI or robots; it will be authentic, irreplaceable human work.

Investors who acquire and consolidate small, human-centric service businesses now—before the true robotic wave hits—can build generational wealth by controlling industries that won't be fully disrupted until well after 2050.

This is the "last frontier" of organic economic value creation before mass automation, and the smart money is already quietly moving in.

1. The Promise vs. Reality of Post-Labor Economics

There's no denying it: We are living through an explosion in artificial intelligence capabilities. From OpenAI’s latest models to autonomous agents, the white-collar workforce is being reshaped at breathtaking speed.

But here’s the catch: the dream of a fully post-labor economy—where robots do everything physical, logistical, and manual—remains stubbornly far off.

According to multiple forecasts, including those aggregated by 80,000 Hours and Goldman Sachs, complete labor substitution by humanoid robots could still take 30–50 years. That's not just a "technology gap"—it's a strategic window for wealth building.

We are in a rare hybrid phase: AI is everywhere in the digital realm, but physical work remains dominantly human.

The ATOMIQ Take: This hybrid phase is where the most significant investment and derisked opportunities are likely to be found.

2. The Case for a Slow Rollout: Bottlenecks Backed by Hard Data

There are several bottlenecks and constraints to consider, including:

A. Material Constraints: The Rare Earth Chokepoint

To scale humanoid robots to replace even a fraction of global labor, we would need to quadruple current global copper production and more than double the production of rare earth magnets.

Right now, China controls about 50% of rare earth refining—a figure that could grow by 2030. With rising geopolitical tensions, access to critical minerals could be throttled even further.

Translation:

Even if we wanted to replace humans tomorrow, the planet physically cannot produce enough robots fast enough without decades of aggressive mining, refining, and global coordination.

Case Study:

The "Rare Earth Crisis" of 2010-2012, when China restricted exports, caused prices for neodymium and dysprosium to spike by 300–500% within months.

Imagine a similar disruption on a global scale in the 2030s.

It's not science fiction, it's basic supply and demand math.

B. Industrial Scaling: History’s Inconvenient Lessons

Remember the automobile? It took almost a full century to saturate global consumer markets.

Indeed, WWII demonstrated that with national focus, factories can be rapidly repurposed (e.g., Ford shifting from car production to tank manufacturing).

In theory, converting existing car plants could enable the production of up to 1 billion robots per year.

However, building new gigafactories, like Tesla’s, still takes 18-24 months, and that's under ideal conditions.

Add in rare earth material shortages, battery constraints, and the complexity of humanoid robots vs. simple cars, and it's easy to see:

Scaling physical automation will be messy, expensive, and slower than the adoption of generative AI.

C. Energy and Cost Barriers

Today’s humanoid prototypes cost between $16,000 and $100,000 each.

They struggle with battery life, typically operating for only 5 hours before needing a recharge. This makes the human worker’s useful workday far more valuable in the near term.

Meanwhile, global energy grids are already straining under the demands of the electric vehicle (EV) revolution and the transition to green energy, and the data centers needed will exponentially increase energy demands from here.

Put Simply:

Mass humanoid deployment = significant new energy burdens.

Current batteries = nowhere near good enough yet.

Full automation = decades away, not years.

3. The Case for Acceleration: Why the Picture Isn’t All Doom and Gloom

A. Breakthroughs in Actuator Technology

One bright spot:

Ferroelectric polymers, also known as "artificial muscles," could enable robots to eliminate motors that depend on rare earths.

If scaled successfully, this could:

Cut robot costs by 30–50%

Reduce material constraints

Speed up manufacturing timelines

Already, prototypes using electroactive polymers are outperforming traditional actuators in terms of flexibility and efficiency.

Key Insight:

Material science—not AI—is the true accelerant to the robotic future.

B. Industrial Agility and AI Factories

Companies like Agility Robotics (creator of Digit) and Tesla are leading the way in AI-driven iterative design.

Tesla's Optimus robot has already improved its capabilities by 30% year-over-year. Self-assembling, AI-assisted factories could shrink build times for robots and robot parts from years to months.

But:

These breakthroughs are still early-stage. Manufacturing scale and real-world ruggedness (especially for outdoor, dynamic human work) remain huge hurdles.

C. Policy and Economic Incentives

Big money is pouring into humanoids:

BMW, Mercedes, Magna: testing humanoids on factory floors

Goldman Sachs projects a $38 billion humanoid market by 2035

Governments worldwide: subsidies, R&D grants, and strategic planning

Yet even with incentives, industrial inertia, materials bottlenecks, and real-world engineering problems mean that the rise of physical automation will take decades, not years.

4. The Hybrid Future: Jobs That Will Survive (and Thrive)

This is the big reveal:

Most high-demand, human-centric jobs will not be automated until at least 2050 or later; yet, millions of small and regional businesses that employ these jobs are owned by Baby Boomers and older Xers who will want to retire or exit in the coming decade.

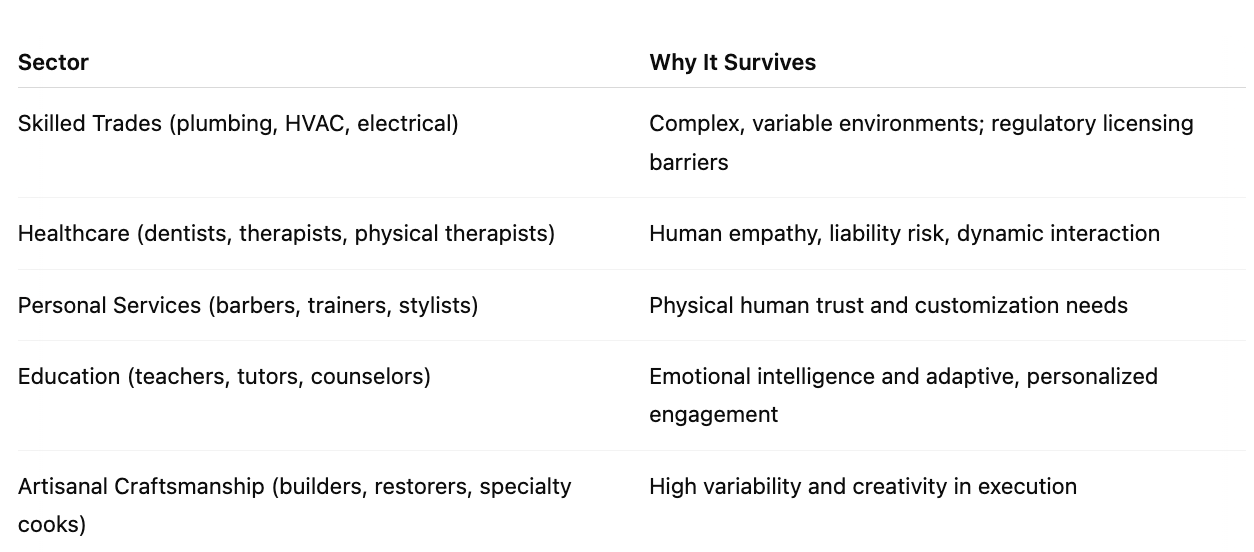

Durable Moats in the Hybrid Economy

Implication:

Work requiring dexterity, judgment, liability management, emotional nuance, or human trust will survive the longest.

The ATOMIQ Take: AI will complement these jobs, not replace them.

The Capitalist Class of the Future: Robot Landlords and Human Service Owners

Owning the companies that hire and manage these tradespeople and professionals will become the modern equivalent of owning land during the agricultural age or factories during the industrial age.

Potential models:

Roll-ups of fragmented service businesses (e.g., HVAC shops, boutique clinics, trades schools)

Franchise systems where branding, marketing, and operations are AI-enhanced, but delivery is still human

Human-centric platforms that aggregate and optimize freelance local labor

The ATOMIQ Take: The bottleneck is not technology—it’s trust and execution.

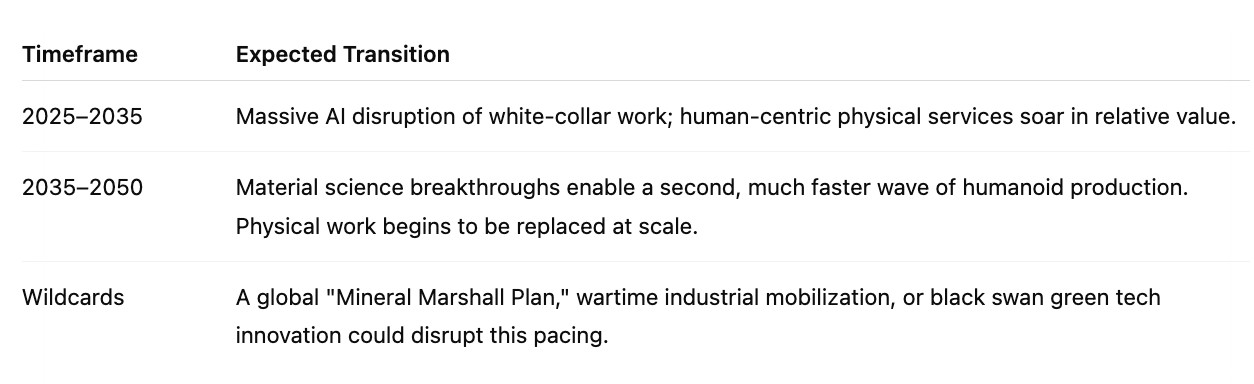

5. Reimagining the Timeline: A Contrarian Macro Perspective

Implication:

The next 25 years represent a peak human opportunity to control physical service delivery markets.

The ATOMIQ Take: The window closes sharply after 2040–2050 as robotic scaling accelerates; however, it is currently wide open.

6. Conclusion: Building Wealth in the Hybrid Human-AI World

You don’t have to fight the future. You have to understand where the bottlenecks are, and invest on the right side of them.

Here’s the simple formula:

Acquire small, fragmented human-centric businesses now

Use AI to make them more efficient internally

Consolidate and brand them for regional dominance

Prepare for an eventual 10- 30x exit by 2045+ when robots finally catch up

Implication: The real moat isn't artificial intelligence.

It’s authenticity, trust, liability management, and human touch.

The ATOMIQ Take: If you own the companies that people still have to call when pipes burst, backs break, teeth ache, family members age, Estates get disbursed, and kids need tutoring, you own the future through 2050.

Acquire human businesses - retool them with AI under the hood

Focus on ones with strong cash flow that can become regionally dominant and grow those cash flows

Acquire Bitcoin with a significant portion of the treasury management

Own the future for generations to come.

~Chris J Snook,

P.S. Reach out to me if you are interested in investing in a prospectus for one of our ATOMIQ search funds.

P.P.S Related posts you may wish to read to deepen your understanding of the forces in play that support this thesis and investment case.

Boomer-Owned Businesses Could Be Your Ticket to Massive Wealth in 2025!

Happy Monday! Inflation is back, the FED acted too soon on their rate cuts, and the melt-up is coming in stocks, crypto, and real estate (hard assets) with the arbitrage for good deals being harder to find. Today, I will give you something to think about that could change all of that. Enjoy the #MacroMonday edition and reach out if you have a solid fami…

The Investment Incentive of the Decade:

While headlines this year have centered on bond market issues, interest rates, geopolitical shocks, and tariff chess matches, the savviest investors are scanning beneath the noise for one thing: asymmetric upside with tax-advantaged protection.

Sources

Humanoid Robots Push the Bounds of Collaborative Manufacturing – AssemblyMag

Where Will the Metals for the Robot Revolution Come From? – Investor News

Flexing New Muscles: Ferroelectric Polymers – BornToEngineer

Electroactive Polymer-Based Composites for Artificial Muscle-Like Actuators – PMC

What Happened to the Rare-Earths Crisis? – MIT Technology Review

A Scarcity of Rare Metals Is Hindering Green Technologies – Yale E360